Why cash flow forecasting is the key to financial peace of mind

Cash flow forecasting is an essential part of what we do at SK Financial. But how does it work and why is it such a valuable tool? Here, we take a closer look at just how much is possible when you carry out a cash flow forecast. We’ve also just upgraded our forecasting system to CashCal and clients are certainly reaping the rewards.

At its core, cash flow forecasting is about gaining clarity and confidence, to allow for better financial decision-making. When setting up a cash flow forecast, we look at a client’s income, expenses, savings and investments and how they could evolve over time. This lays out if you are on track to achieve your goals. It also becomes a vital tool when you are making important decisions, such as when to retire or maybe whether buying or selling a house is viable.

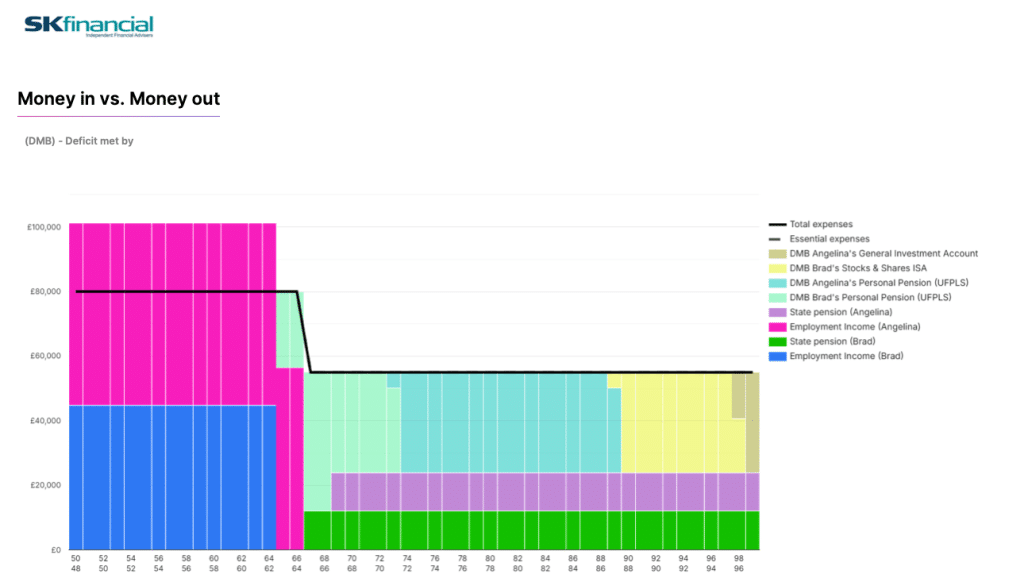

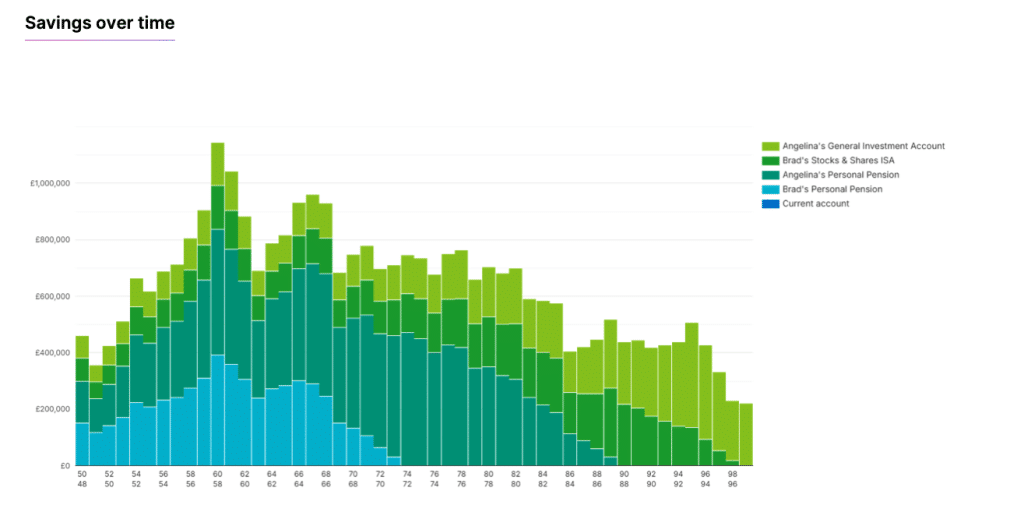

This process gives you a clear visual perspective on your finances. When dealing with finances, you are presented with a lot of numbers, and it’s often difficult to translate them and understand what they actually mean. One of the great benefits of a cash flow forecast is that it presents these figures in a more digestible format, using easy-to-understand graphs and charts that are colour-coded. It just makes it so much easier to see what’s really going on with your finances.

The ability to scenario plan helps to make informed decisions

In reality, for most people, the answers to a lot of the big questions people have (When should I retire? etc) are not set in stone. The great thing about a cash flow forecast (once the information is inputted) is that we can easily manipulate the scenarios to show different versions of events. For instance, what life will look like financially if you retire at 60 or 65, or if you can spend £50k a year or £70k a year. When we have meetings in person, we can quickly show these scenarios within the flow of the conversation.

For clients thinking about inheritance, inter-generational planning, or lifetime gifting, cash flow models help determine what’s affordable and tax-efficient whilst accounting for their own financial security. Something that looks to be even more important with the upcoming legislation changes.

It is worth remembering though that we are always working on assumptions and the reality of life is that things change constantly. But there is no doubt that cash flow can be used to focus financial conversations and make more detailed plans for the future. It can also be updated frequently.

Why we use CashCal

We recently introduced a new way of doing our cash flow forecasting, using a product called CashCal. We settled on CashCalc after an extensive search for the right system. And we’re excited about the opportunities this new system offers.

One of the main benefits of CashCal is the integration. The forecasting system is fully integrated with the risk profile and fact find elements of our platform. This means that when a client completes a fact find document and inputs their information, these results and answers pull through the cash flow.

In addition to this, once a client has completed an attitude to risk questionnaire, these results are also pulled through to the cash flow and applied to their investments. In the past we have used linear investment performance i.e., for a medium growth portfolio, you would assume a 5% growth rate per annum. The reality of the investment markets is that there are peaks and troughs for a multitude of reasons (seems like more and more every year) so a linear growth rate is just not as accurate. What CashCalc does is take your risk score and then uses past performance data of investments at that level of risk and projects them over the cash flow. This provides a much more accurate picture of how investments perform over the long term.

And finally, Cashcal offers simple, colourful graphs. This may not sound like much, but making people’s finances easy to understand and nice to look at makes a huge difference. Ever since we switched to CashCalc, we have received positive feedback about how graphs really make sense. Helping people make sense of their finances is ultimately what this is all about.

Below are a couple of examples of how the graphs look. If you would like us to carry out an up to date cash flow forecast with you, please do get in touch.